Private Limited Company Registration in Bangalore

Private Limited Company Registration is one of the most widely preferred business structures in India for startups, entrepreneurs, and growing businesses. This structure provides limited liability protection to owners, a separate legal identity to the company, and higher credibility in the market.

The registration of a Private Limited Company is governed by the Companies Act, 2013 and is regulated by the Ministry of Corporate Affairs (MCA).

Key Requirements & Documents :

Core Requirements –

To register a Private Limited Company in India, certain legal and structural requirements must be fulfilled. The company must have a minimum of two directors and two shareholders. These roles can be held by the same individuals. At least one director must be a resident of India, as defined under the Companies Act, 2013.

The company must have a unique and legally compliant name, a registered office address within India, and clearly defined business objectives. Directors are required to obtain a Digital Signature Certificate (DSC) to sign electronic documents and a Director Identification Number (DIN) to be legally recognised as directors. These requirements ensure transparency, accountability, and proper regulation of corporate entities.

Documents Required –

- Identity Proof of Directors and Shareholders

PAN card is mandatory for all Indian directors and shareholders. Aadhaar card or passport is required as additional identity proof to verify personal details as per MCA records. - Address Proof of Directors and Shareholders

Address proof such as bank statement, utility bill, or official government document is required to confirm the residential address. The document should be recent and clearly readable. - Passport-Size Photographs

Recent passport-size photographs of all directors and shareholders are required for incorporation records and statutory filings. - Registered Office Address Proof

Proof of the registered office address must be submitted in the form of an electricity bill, water bill, or other utility bill, along with ownership proof or a valid rent or lease agreement. - Consent and Declaration Forms

Statutory consent and declaration forms, as prescribed by the Ministry of Corporate Affairs, are required from directors and subscribers to confirm compliance with legal requirements. - Additional Supporting Documents (If Applicable)

In certain cases, additional documents may be requested by the Registrar of Companies for verification or clarification during the registration process.

Any mismatch, incorrect information, or incomplete documents can lead to delays or rejection of the application. Professional verification helps ensure accuracy and smooth approval.

Private Limited Company Registration Process

- Obtain Digital Signature Certificate (DSC)

The first step is to obtain a Digital Signature Certificate for the proposed directors. DSC is mandatory for signing electronic forms submitted on the Ministry of Corporate Affairs (MCA) portal. - Apply for Director Identification Number (DIN)

Every director must have a Director Identification Number issued by the MCA. DIN is used to identify directors and is required for filing incorporation documents.

- Reserve Company Name

A unique company name is applied for through the MCA portal. The name must comply with naming guidelines and should reflect the business activity. Approval of the name is necessary before proceeding further. - Prepare Incorporation Documents

Documents such as the Memorandum of Association (MOA) and Articles of Association (AOA) are drafted to define the company’s objectives, rules, and internal management structure. - File Incorporation Forms with MCA

After preparing documents, incorporation forms are filed online through the MCA portal. This includes submission of director details, registered office address, and statutory declarations. - Verification by Registrar of Companies (ROC)

The Registrar of Companies reviews the application, documents, and compliance details. If everything is found correct, the application is approved. - Issue of Certificate of Incorporation

Once approved, the ROC issues the Certificate of Incorporation. From this date, the Private Limited Company legally comes into existence as a separate legal entity.

SPICe+ Form :

SPICe+ Form Part A – Reserve Your Name

SPICe+ Part A is used exclusively for reserving the company name. Applicants can propose names along with the main business objectives. The MCA examines the name based on availability, similarity with existing companies, and compliance with legal naming rules. Choosing the correct name at this stage is important to avoid rejection and delays.

SPICe+ Form Part B – Incorporation Requirements

SPICe+ Part B is used for complete company incorporation. It includes details of directors and shareholders, registered office address, capital structure, and filing of MOA and AOA. This form also allows automatic application for PAN and TAN, making the incorporation process faster and more streamlined under a single integrated system.

Approximate Costs of Private Limited Company Registration

The cost of registering a Private Limited Company depends on several factors, including government fees, authorised share capital, and professional service charges. Government fees are fixed by the MCA, while professional charges vary depending on documentation, compliance support, and post-registration services.

Although the cost may differ from case to case, Private Limited Company registration should be viewed as a long-term investment. The legal protection, credibility, and scalability it offers far outweigh the initial incorporation expenses.

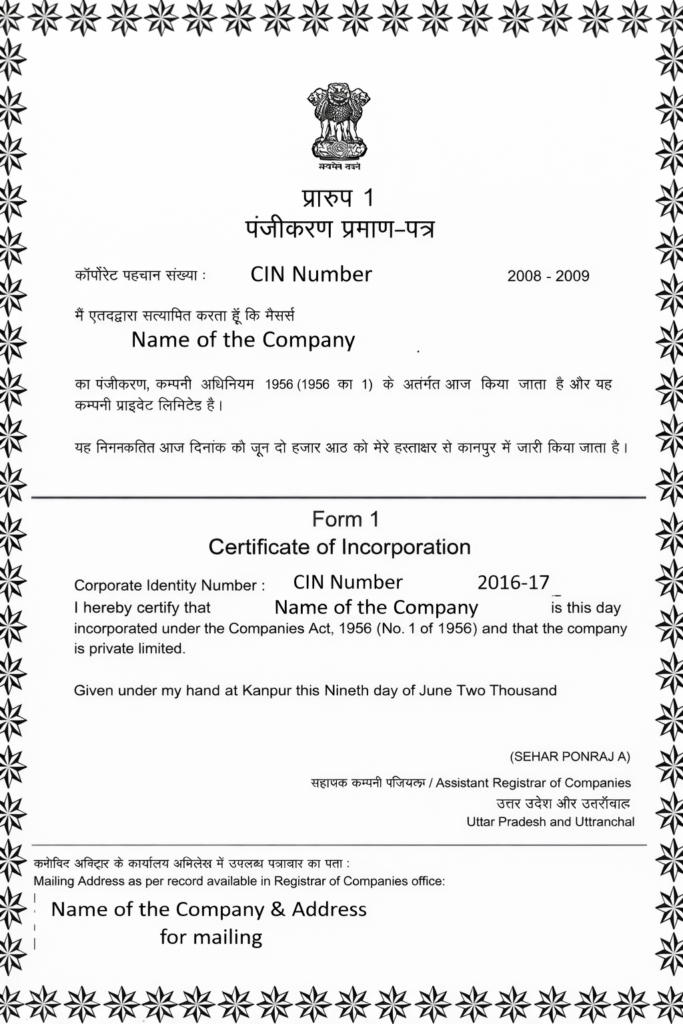

Private Limited Company Incorporation Certificate :

After successful registration, the Registrar of Companies issues a Certificate of Incorporation, which serves as legal proof of the company’s existence. It contains the company name, CIN, date of incorporation, and MCA seal.

This certificate is mandatory for opening a bank account, applying for GST, and conducting business operations.

Post-Registration Checklist

Once the company is incorporated, certain compliances must be completed to ensure smooth functioning. These include opening a company bank account, issuing share certificates, appointing a statutory auditor, maintaining statutory registers, and filing initial MCA compliances.

Failure to complete post-registration compliances on time may attract penalties. Proper post-incorporation support ensures that the company remains compliant from the very beginning.

Who is Eligible for Private Limited Company Registration?

Private Limited Company registration is open to Indian citizens, NRIs, and foreign nationals, subject to applicable laws. Any individual or group planning to start a scalable business with limited liability can choose this structure.

This form is ideal for startups, technology companies, service providers, manufacturing units, and businesses planning to raise funds or expand operations in the future.

Private Limited Company Registration Time

On average, Private Limited Company registration takes 7 to 10 working days, provided all documents are correct and the proposed name is approved without objection. The timeline may vary depending on government processing and document readiness.

Things That Delay a Registration Process

Delays usually occur due to incorrect documents, name rejection, mismatch in personal details, or incomplete information. Professional handling significantly reduces such delays and ensures faster approval.

Bharat e-Filing provides end-to-end Private Limited Company registration services with a focus on accuracy, transparency, and legal compliance. From document verification and SPICe+ filing to post-registration support, our experts handle the complete process.

With personalised assistance, timely updates, and clear pricing, Bharat e-Filing ensures a smooth and stress-free company registration experience.

Conclusion

Private Limited Company Registration provides a strong legal foundation for starting and growing a business in India. With limited liability, better credibility, and structured compliance, it is the most trusted business structure for entrepreneurs.

With Bharat e-Filing, the registration process becomes simple, accurate, and legally compliant from day one.

FAQs

- Is there any minimum capital requirement?

No, there is no minimum paid-up capital requirement under current law. - Can foreign nationals be directors or shareholders?

Yes, subject to FEMA and MCA compliance. - Is GST registration mandatory after incorporation?

GST is required only if the business meets prescribed criteria. - Can the company name be changed later?

Yes, the name can be changed by following the legal procedure. - Is Private Limited Company best for startups?

Yes, it is the most preferred structure for scalable startups.