LLP Registration in Hyderabad

Hyderabad has rapidly evolved into a major commercial and startup hub in India, attracting entrepreneurs, professionals, consultants, and service-based businesses. With the rise of small and medium enterprises, choosing the right legal structure has become an important decision for business owners. Limited Liability Partnership (LLP) is one of the most preferred structures for those who want operational flexibility along with legal protection.

LLP registration in Hyderabad provides the advantage of limited liability to partners while allowing them to manage the business with fewer compliance requirements compared to a private limited company. Governed by the Limited Liability Partnership Act, 2008, an LLP is registered with the Ministry of Corporate Affairs (MCA) and enjoys a separate legal identity. This means the LLP can own assets, enter into contracts, and continue its existence independent of changes in partners.

What is LLP Registration?

LLP Registration is the legal process of forming a Limited Liability Partnership by registering it with the Ministry of Corporate Affairs. Once registered, the LLP is recognised as a separate legal entity distinct from its partners. This structure combines the benefits of a traditional partnership and a company by offering limited liability protection along with flexible internal management.

In an LLP, partners are not personally liable for the negligence or misconduct of other partners. The rights, duties, and profit-sharing ratio of partners are governed by an LLP Agreement, making it a transparent and well-structured business model. LLP registration is especially suitable for professionals, consultants, and service-oriented businesses looking for credibility without heavy compliance.

Prerequisites for LLP Registration

Before applying for LLP registration in Hyderabad, certain statutory conditions must be fulfilled. An LLP must have a minimum of two designated partners, and at least one designated partner must be a resident of India as per legal requirements. Designated partners are responsible for compliance and regulatory filings.

All designated partners must obtain a Digital Signature Certificate (DSC) for signing electronic documents and a Designated Partner Identification Number (DPIN) issued by the MCA. In addition, the LLP must have a unique and legally compliant name, a registered office address in India, and a clearly defined business activity to be mentioned in the LLP Agreement.

Documents Required for LLP Registration

Accurate and complete documentation is essential for LLP registration, as all documents are carefully verified by the Registrar of Companies (ROC) to confirm the identity, address, and eligibility of partners, as well as the existence of the registered office.

- PAN Card of Partners

PAN card is mandatory for all Indian partners and is used for identity verification and tax-related compliance during LLP registration. - Aadhaar Card or Passport (Identity Proof)

Aadhaar card is required for Indian nationals, while a valid passport is mandatory for foreign nationals and NRIs to establish identity as per MCA requirements. - Address Proof of Partners

Documents such as bank statements, electricity bills, or other utility bills are required to verify the residential address of partners. The address proof should be recent and clearly readable. - Passport-Size Photographs

Recent passport-size photographs of all partners are required for incorporation records and statutory filings with the Ministry of Corporate Affairs. - Registered Office Address Proof

Proof of the LLP’s registered office must be submitted in the form of an electricity bill or utility bill, along with ownership proof or a valid rent or lease agreement. - Draft LLP Agreement

The LLP Agreement defines the roles, responsibilities, capital contribution, and profit-sharing ratio of partners and is a key legal document for LLP operations. - Statutory Consent and Declaration Forms

Mandatory consent and declaration forms prescribed by the Ministry of Corporate Affairs must be submitted to confirm compliance with the LLP Act.

Any mismatch, incorrect information, or incomplete documents may lead to delay or rejection of the LLP registration application.

Step-by-Step Registration Process

- Obtain Digital Signature Certificate (DSC)

The registration process begins with obtaining a Digital Signature Certificate for all designated partners. DSC is mandatory for signing and submitting electronic incorporation forms on the Ministry of Corporate Affairs (MCA) portal. - Apply for Designated Partner Identification Number (DPIN)

Every designated partner must obtain a DPIN, which is issued by the MCA. This identification number is used to track partner details and is required for LLP incorporation and future compliance filings. - Reserve the LLP Name

The proposed LLP name is applied for as per MCA naming guidelines. The name must be unique, relevant to the business activity, and not identical or similar to existing entities. - Prepare and File Incorporation Forms

Once the name is approved, incorporation forms along with all supporting documents are prepared and filed with the Registrar of Companies. These forms include details of partners, registered office address, and business activity. - Verification by Registrar of Companies (ROC)

The Registrar of Companies examines the submitted application and documents to ensure compliance with the Limited Liability Partnership Act, 2008. Any discrepancies may lead to queries or resubmission. - Issue of Certificate of Incorporation

After successful verification, the ROC issues the Certificate of Incorporation. From this date, the LLP legally comes into existence as a separate legal entity.

Post-Registration Requirements

After LLP incorporation, certain post-registration compliances must be completed to make the LLP fully operational. These include execution of the LLP Agreement within the prescribed timeline, opening a bank account in the LLP’s name, and applying for GST registration if the business falls under GST applicability.

Completing these steps on time ensures smooth business operations, prevents penalties, and establishes the LLP as a compliant and credible business entity.

Compliances for Limited Liability Partnership

LLPs are required to comply with annual statutory filings, regardless of turnover or profit. Mandatory compliances include filing the Annual Return (Form 11) and the Statement of Accounts & Solvency (Form 8) within prescribed due dates.

If the LLP’s turnover exceeds the limits specified under law, audit becomes mandatory. Timely compliance helps avoid penalties and ensures that the LLP maintains its active legal status with the MCA.

Time and Cost Required for LLP Registration

LLP registration in Hyderabad generally takes 7 to 10 working days, provided all documents are accurate and the proposed name is approved without objection. Delays may occur if documents are incomplete or require clarification.

The cost of LLP registration depends on government fees and professional charges. Compared to company incorporation, LLP registration is relatively cost-effective and suitable for small and medium-sized businesses.

Advantages and Disadvantages of LLP Registration

Advantages of LLP

LLP offers limited liability protection, ensuring partners’ personal assets are safeguarded. It provides management flexibility, no minimum capital requirement, and fewer compliance obligations. LLP is ideal for professionals and service-based businesses.

Disadvantages of LLP

LLPs cannot raise equity funding like private limited companies, which may limit scalability. Certain annual compliances are mandatory even if there is no business activity.

Checklist for LLP Registration

Before applying for LLP registration, ensure the following checklist is complete:

- Minimum two designated partners available

- DSC and DPIN obtained

- Unique LLP name finalised

- Registered office address proof ready

- Identity and address documents verified

- LLP Agreement draft prepared

A complete checklist helps avoid unnecessary delays.

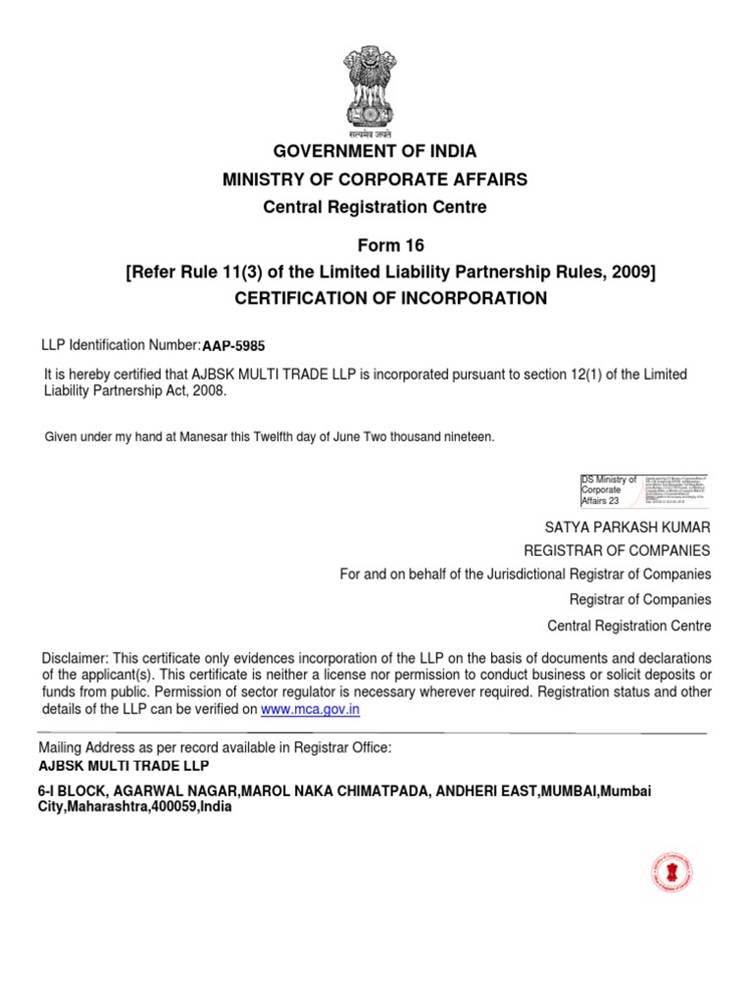

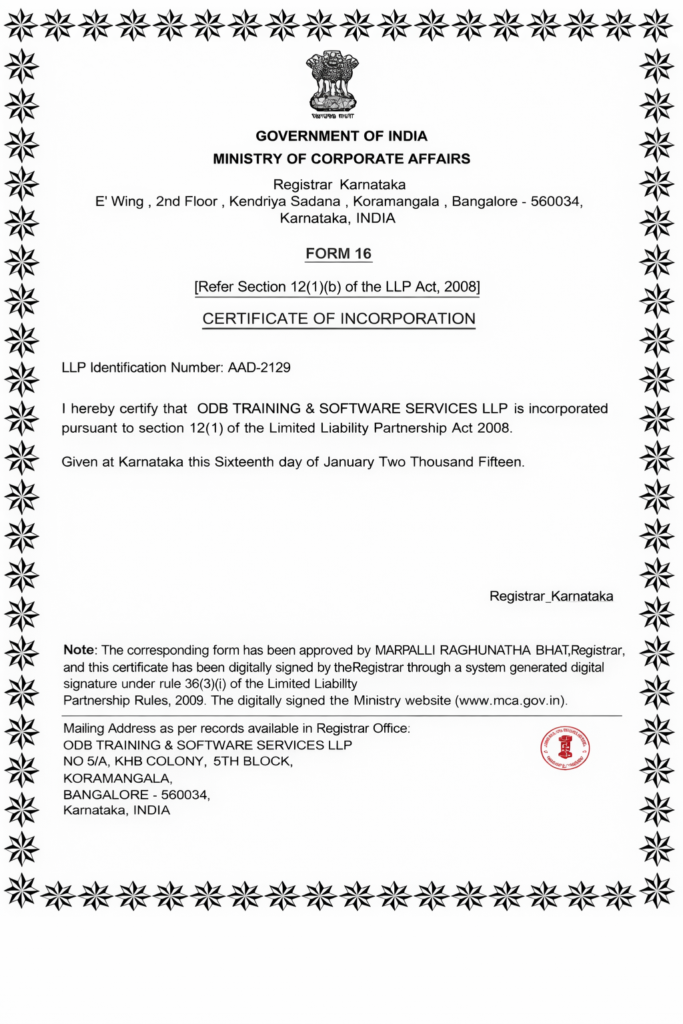

LLP Certificate of Incorporation – Sample

After successful registration, the Registrar of Companies issues the LLP Certificate of Incorporation, which serves as official proof of the LLP’s legal existence. It includes the LLP name, LLPIN, date of incorporation, and MCA seal.

This certificate is required for opening a bank account, applying for GST, and entering into legal contracts.

Why Choose Bharat e-Filing for LLP Registration in Hyderabad?

Bharat e-Filing offers end-to-end LLP registration services with a strong focus on legal accuracy, transparency, and timely execution. Our experts handle documentation, MCA filings, follow-ups, and post-registration compliance support.

With personalised assistance, clear pricing, and professional guidance, Bharat e-Filing ensures a stress-free LLP registration experience.

Conclusion

LLP registration in Hyderabad is an excellent choice for entrepreneurs and professionals who want flexibility, limited liability, and lower compliance burden. With proper documentation and expert support, the registration process becomes smooth and legally secure.

FAQs

Is LLP registration mandatory to start a business?

It is not mandatory, but highly recommended for legal protection and credibility.

Is there any minimum capital requirement for LLP?

No, there is no minimum capital requirement.

Can foreign nationals become LLP partners?

Yes, subject to FEMA and MCA compliance.

Is GST registration mandatory after LLP registration?

Only if the business meets GST applicability criteria.

How long does LLP registration take?

Usually 7–10 working days with proper documents.